With a Credit Builder Account*, you can build credit and savings at the same time.

Purchase a Self Retail Card and use the code on the back to make your first payment and kick off your credit building journey.

Set aside a safety fund.

At the end of your plan, you’ll get back as much as $520.

How it works

1

Apply for a Credit Builder Account.

2

Make monthly payments for 24 months1 to build credit and add to your savings.

3

Unlock your savings at the end – minus interest and fees.

Features

No Hard Pull

There is no hard pull on your credit when applying for a Self Credit Builder Account.

Automate Payments

Autopay can help you stay on track without worrying about due dates.

Track Your Credit Score

Watch how your score changes over time – at no extra cost.

Reports to all 3 bureaus

Every payment is reported to all three credit bureaus.

Cancel anytime

We know making payments isn’t always easy. That’s why you can cancel at any time and get your savings progress back, minus interest and fees.

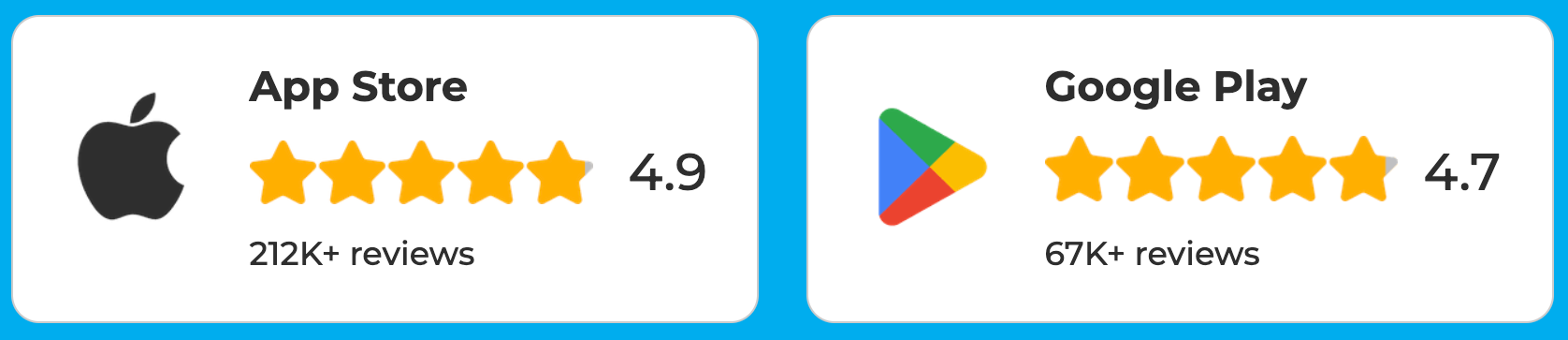

More than 2.5 million have signed up to build with Self.

Join them with your own Credit Builder Account — no credit needed.

As Featured In:

Frequently asked questions

Once your account is up and running, we suggest you add a payment method2 (like a bank account or a debit card) to more easily make your monthly payments and build your credit. You can also make cash payments in thousands of retail locations around the US.

No. The Self gift card can only be used to open a new Credit Builder Account and make the first payment of a $25/mo plan.

Call our partner, Incomm, at 1-833-586-7726, and request a refund.

Credit Builder Account — proceeds are held in a deposit account until maturity

Results are not guaranteed. Improvement in your credit score is dependent on your specific situation and financial behavior. Failure to make monthly minimum payments by the payment due date each month may result in delinquent payment reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report.

* All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender or Sunrise Banks, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. Citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. All Certificates of Deposit (CD) are deposited in Lead Bank, Member FDIC or Sunrise Banks, N.A., Member FDIC.

Lead Bank. Member FDIC, Equal Housing Lender

Sunrise Banks, N.A. Member FDIC, Equal Housing Lender

1 Sample product is a $25 monthly loan payment at a $520 loan amount, 24 month term and 15.92% Annual Percentage Rate.

2 Each payment method may incur different fees. Fee details are provided when the customer chooses a payment method.